Take your Second Brave Action

A number of life’s essential milestones rely towards the taking recognized to possess a loan. Financing officers help individuals realize specifications they may has actually wanted its entire existence, such as for example to find property, money a child’s studies, otherwise opening a corporate. Work away from financing officers entails underwriting financing for people and you will people, probably reshaping their futures. Those with strong interpersonal and you can business experience exactly who end up being motivated because of the the opportunity to transform a corporate otherwise build somebody’s fantasy possible is always to can getting a loan manager.

How much does that loan Officer Would?

Loan officers evaluate loan requests from individuals and enterprises and you will level mortgage requires and you can creditworthiness. Based their power, loan officials commonly both agree that loan or strongly recommend the approval. The fresh new credit process concerns get together and you will confirming required monetary data and you can upcoming determining whether your guidance provided warrants the fresh new monetary danger of issuing financing. Of numerous financial institutions have fun with certified app one to helps mortgage officers in the their choice-making.

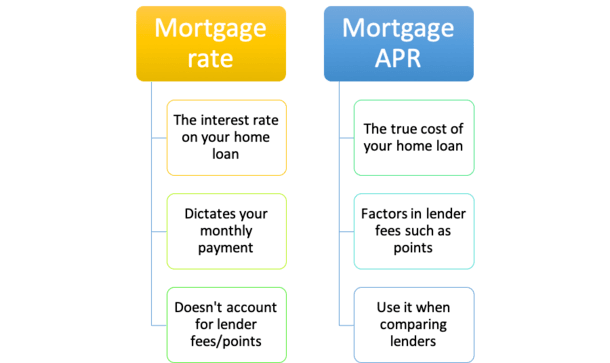

Loan officials benefit loan providers, such as finance companies and you can borrowing unions. Its services manage dealing with particular financial loans its establishments provide. These items you will tend to be personal lines of credit and other particular finance such as for example mortgages. Financing officials render consultations on their subscribers in the and therefore things commonly ideal meet their requirements. Then they book borrowers from the financing processes. To achieve this, mortgage officers have to be well-acquainted the institution’s available lending options and be able to identify all of them. They want to in addition to cause for the new creditworthiness away from prospective borrowers whenever suggesting an item. Fundamentally, loan officers need to comprehend the rules and you will statutes ruling new banking world to make sure an appropriately executed mortgage.

- Following the leads having potential borrowers

- Talking to customers to collect information that is personal and you may explore financial loans

- Guaranteeing new contents site here of loan applications and determining finance to possess acceptance or denial

- Guaranteeing money comply with federal and state regulations

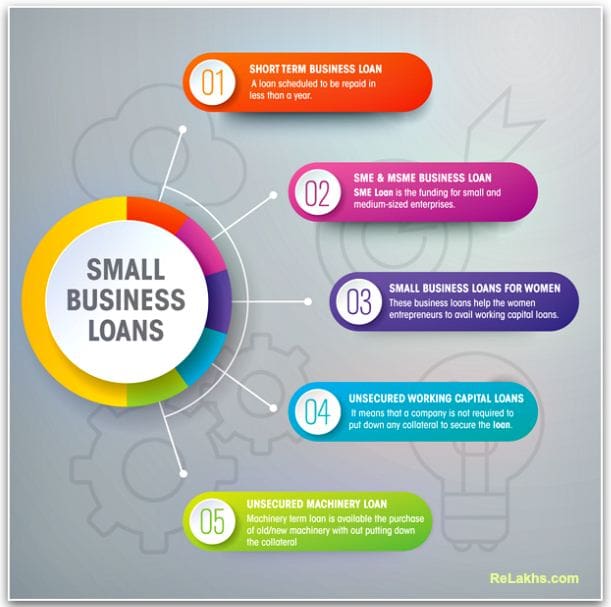

- Commercial financing officials perform loans, and therefore tend to be huge and much more state-of-the-art than other loan typesmercial mortgage officials need to get to know have a tendency to difficult economic items of companies when creating choices. They could in addition to complement together with other credit organizations when the more you to financial was covering the complete number of the cash getting questioned.

- Personal bank loan officials manage money to people, that cover expenses eg auto purchases. It publication their customers from the lending techniques, have a tendency to having fun with underwriting application, and this find recognition otherwise assertion away from convenient financing. not, personal loan officers in the shorter finance companies otherwise borrowing from the bank unions you are going to influence creditworthiness versus underwriting software.

- Mortgage officials would money employed for domestic or industrial genuine house. They may help businesses otherwise somebody buy otherwise refinance attributes. Often what they do concerns soliciting providers out-of a home companies.

Methods being a loan Manager

People who have a desire for organization and loans can be come across an excellent possibly satisfying job street because of the learning how to feel that loan administrator. A variety of ideal training and you will feel can result in triumph in the wide world of lending and you can money.

1: Secure a Bachelor’s Knowledge

Most financial institutions desire hire financing officials with received at the least an effective bachelor’s education. Loan officers constantly keep an excellent bachelor’s education inside finance or good relevant community such as for example organization otherwise accounting. An effective bachelor’s knowledge in financing provides the important organization and you may fund record financing officers must create its jobs. This new courses offers programs that develop students’ comprehension of economic bookkeeping and administration and create communication event related to the business world. Classes together with teach making use of analytical products strongly related financing officers that can help all of them evaluate and you can translate monetary and you will bookkeeping suggestions.

2: Obtain Works Feel

And additionally good bachelor’s education, early in the day really works experience with financial, customer care, or conversion process also provides work individuals an aggressive virtue. Loan officers deal with significant amounts of documentation and you may would logistics. Men and women seeking becoming mortgage officers would be to take part in works that expands the individuals experiences. Loan officials including publication somebody thanks to a typically not familiar and potentially anxiety-promoting processes. Earlier in the day works experience you to generates social experience also can build a loan administrator appealing to prospective employers.

Step three: Receive Certification (Optional)

Many loan officers are not expected to see licensure, of several to get experience to enhance the background. Real estate loan officials, yet not, must see qualification. A mortgage loan maker (MLO) license needs 20 period out of training, winning conclusion of an examination, and you will distribution so you can history and you will credit monitors.

Several financial contacts give extra training, for each using its own conditions. Always candidates need done coursework and have 36 months of functions experience. Carrying for example a certificate helps verify a loan officer’s competence in the the new credit company.

Financing Administrator Wages

Loan officers’ salaries assortment generally, into bottom 10 percent making around $33,000 a-year while the top 10 per cent getting around $136,000 a-year, with respect to the You.S. Agency away from Labor Analytics (BLS). The newest median income to possess mortgage officers is actually $64,660 into the . Some of these professionals discover profits because of their really works, while others earn apartment salaries.

Median wages having mortgage officials in the finest groups one use are usually: $84,230 annually to have financing officers who do work getting vehicles people, $68,740 just in case you work with company and you will enterprise administration, and you will $63,420 for those with roles for the credit intermediation, according to BLS.

Coming Business Growth to own Mortgage Officials

The latest BLS systems eleven per cent job growth for mortgage officers of 2016 in order to 2026, which equates to thirty six,300 the latest perform. As the cost savings expands, companies and individuals may look for funds, leading to an elevated number of efforts to possess financing officials.

Initiate Your Journey To the As that loan Officer

Now that you have discovered how to be a loan administrator and you can exactly what mortgage officers perform, make foundation of that it fulfilling industry from the investigating Maryville University’s on the web bachelor’s inside the fund to find out more on which it will take to succeed given that that loan officer.

Be Brave

Give all of us your own aspiration and we will guide you collectively a customized path to a quality degree that’s made to change your lifetime.