In the event the catalog off residential property available for purchase try lowest however, request is high eg now! to invest in good fixer-upper will help first-time homebuyers rating a toes in the home (literally). In case a house needs more than just specific cosmetic matches, you could question the way to afford to purchase a home and repair it right up.

Generally speaking, homes which need some really works is actually priced accordingly. This means you will be able to find good fixer-top and possess some space on the complete home budget so you can remodel. Nonetheless it you will wanted serious cash readily available to safeguards a deposit, settlement costs or any other charge, together with cost of (maybe biggest) home improvements. Regardless of if you may be convenient and you will envision you certainly can do particular otherwise every work yourself, the price of materials you will save some money.

Let’s say you have been preapproved to own a mortgage loan regarding up so you can $250,000, you commonly viewing of numerous flow-in-in a position land towards you where budget. You notice a house having higher skeleton, virtually no curb appeal, and lots of serious activities listed on $150,000. Your real estate professional estimates it demands in the $75,000 property value performs. The brand new shared $225,000 is actually your overall budget you do not have $75,000 (also a down payment and closing costs) sitting about financial! This is where res come in.

Your sure normally! Of numerous loan providers give software that allow you to move the purchase price from repairs or home improvement on the loan amount, as long as you have the ability to be eligible for a complete loan amount which takes care of the purchase price also renovations.

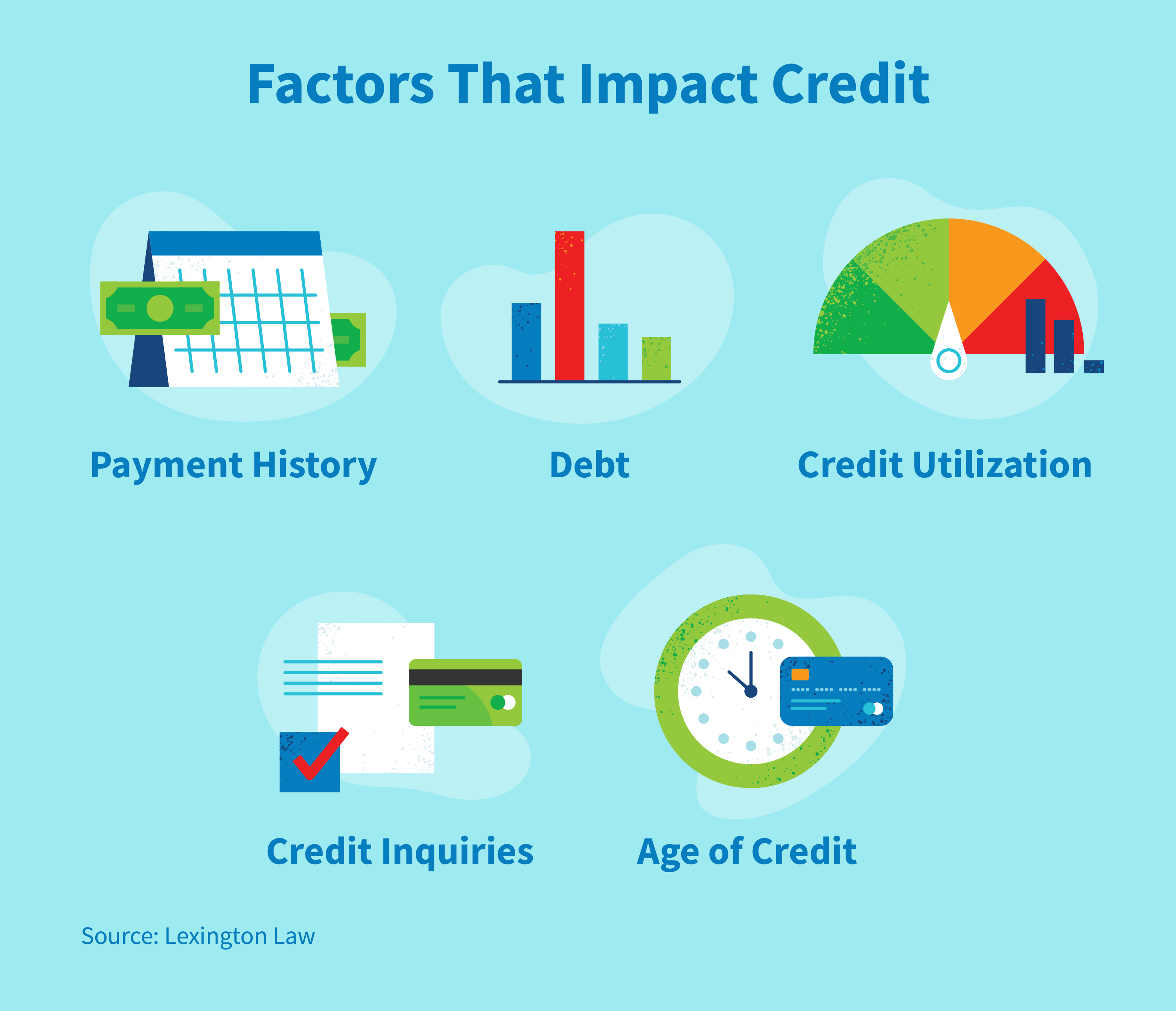

You’ll be eligible for a renovation mortgage just like you do one almost every other mortgage loan. The lender will appear at your money, expense, and you may credit score to assess your capability to settle to discover exactly how much they will getting willing to lend you. Repair finance don’t automatically come with highest interest levels. Your interest rate could well be determined by new usual affairs, together with your credit score, debt-to-income ratio, and you may what’s happening on housing marketplace.

Loan providers s designed to assist rejuvenate aging family inventory and make homebuying less costly, like Fannie mae HomeStyle Recovery otherwise Freddie Mac computer CHOICERenovation (much more about those underneath) otherwise FHA 203(k). Lenders s. Only a few loan providers bring renovation loans, so make sure you ask loan providers what do it yourself programs s works.

Fannie mae HomeStyle Repair and payday loans you will Freddie Mac computer CHOICERenovation

Federal national mortgage association and Freddie Mac computer each other bring a lso are that can allows you to ft the amount your borrow secured on precisely what the household was well worth after you improve they.

- You can include the next regarding loan amount: settlement costs, charge and you may prepaid service situations, labor, information, architect costs, permits, licenses, contingency reserves, or over so you can six months’ mortgage payments (due to the fact you can easily most likely be expenses to live somewhere else within the renovations)

- You are in charge to find a professional, experienced builder and discussing the price of your advised renovations but your lender will have to accept new company in addition to their agreements, requisite and you will deals

- Home improvements need to be accomplished within 1 year out-of closure the mortgage

For HomeStyle Restoration and you will CHOICERenovation money, down payment standards are derived from sometimes the new property’s article-restoration really worth and/or price plus restoration prices. Getting a-one-equipment number one residence, you’ll want to put down a minimum of 5%. The newest downpayment minimal drops to 3% for individuals who qualify for the fresh matching value program from the Federal national mortgage association otherwise Freddie Mac HomeReady otherwise Domestic You’ll, respectively. Other standards apply for 2nd family, multi-tool services or funding properties.

As with any old-fashioned mortgage, if you do set below 20% down, the lender will require mortgage insurance that is canceled once you visited 20% guarantee of your house, because of while making money on your financing and you may/otherwise household rate love.

You can also be eligible for advance payment assistance to let defray those individuals costs, thus definitely look possible software and check with your lender!

Can i spend less performing the work myself?

You may be capable save some costs to the labor performing some of the renovation work oneself, with respect to the regards to new lso are. That is an area where in actuality the national res I secured significantly more than differ.

Having a fannie mae HomeStyle Repair mortgage for a one-product property, Diy developments tends to make as much as ten% of one’s blog post-repair worth, if you get lender’s recognition. This enables you to save on labor and you can financing only the price of the materials, in addition to contingency funds in case you need certainly to get some one to get rid of the work. You can’t tend to be funds in order to pay your self for the labor. When you have currency left in your funded matter immediately following doing the task, you could potentially use it on the harmony of your own mortgage or build significantly more developments.

New Freddie Mac CHOICERe makes you do a little works oneself provided your loan is also part of the Freddie Mac computer Domestic You are able to value program. In this situation, the work you are doing known as sweating security commonly amount with the your down-payment and you may closing costs. The value of their perspiration equity must be estimated from the an appraiser prior to starting renovations, plus Doing it yourself work have to be checked and certified of the an appraiser when complete.

People lso are which enables Do-it-yourself work are priced between limits towards precisely what kinds of Diy work is welcome. Their program could possibly get allows you to color the inside of one’s domestic, including, however, require all electrical try to be carried out by a licensed electrician.

Brand new upshot? If you are handy and you can/otherwise prepared to put in the time and effort a part of handling a builder and you may controlling the documentation, a remodelling financing may indeed make the improvement to you personally inside the regards to in search of and you may affording a home!