FHA Money Defined

ily and purchase their earliest home, nonetheless they have difficulties. The happy couple does not have any almost adequate money to the 20% deposit necessary for the financial institution to possess antique funding. Their private banker advises your few go with FHA financial support.

New FHA guarantees the financial institution up against the borrower’s default of the financing. As the FHA insures the loan, loan providers under the program are prepared to provide financial support to folks instance Mark and you can Chloe that simply don’t can afford to a great big downpayment. FHA resource is present for both solitary family unit members and you can multiple family members homes doing five gadgets, such good duplex.

Certification

Draw and Chloe get a much easier date qualifying to possess an FHA covered financial than a traditional loan. Rather than the typical 20% downpayment, they can to acquire a keen FHA insured mortgage with a deposit equivalent to just step three.5% of your purchase price of the house. For example, an excellent 20% downpayment towards the a good $150,000 home is $31,000, nevertheless downpayment can be lower because $5,250 which have a keen FHA insured financing. This might be essential because protecting up for a down payment is one of the most important obstacles up against first-time homebuyers. As well, consumers usually can have down fico scores than simply having old-fashioned lending. Actually, it could be you can to be eligible for an FHA covered loan merely two years just after getting a release in case of bankruptcy.

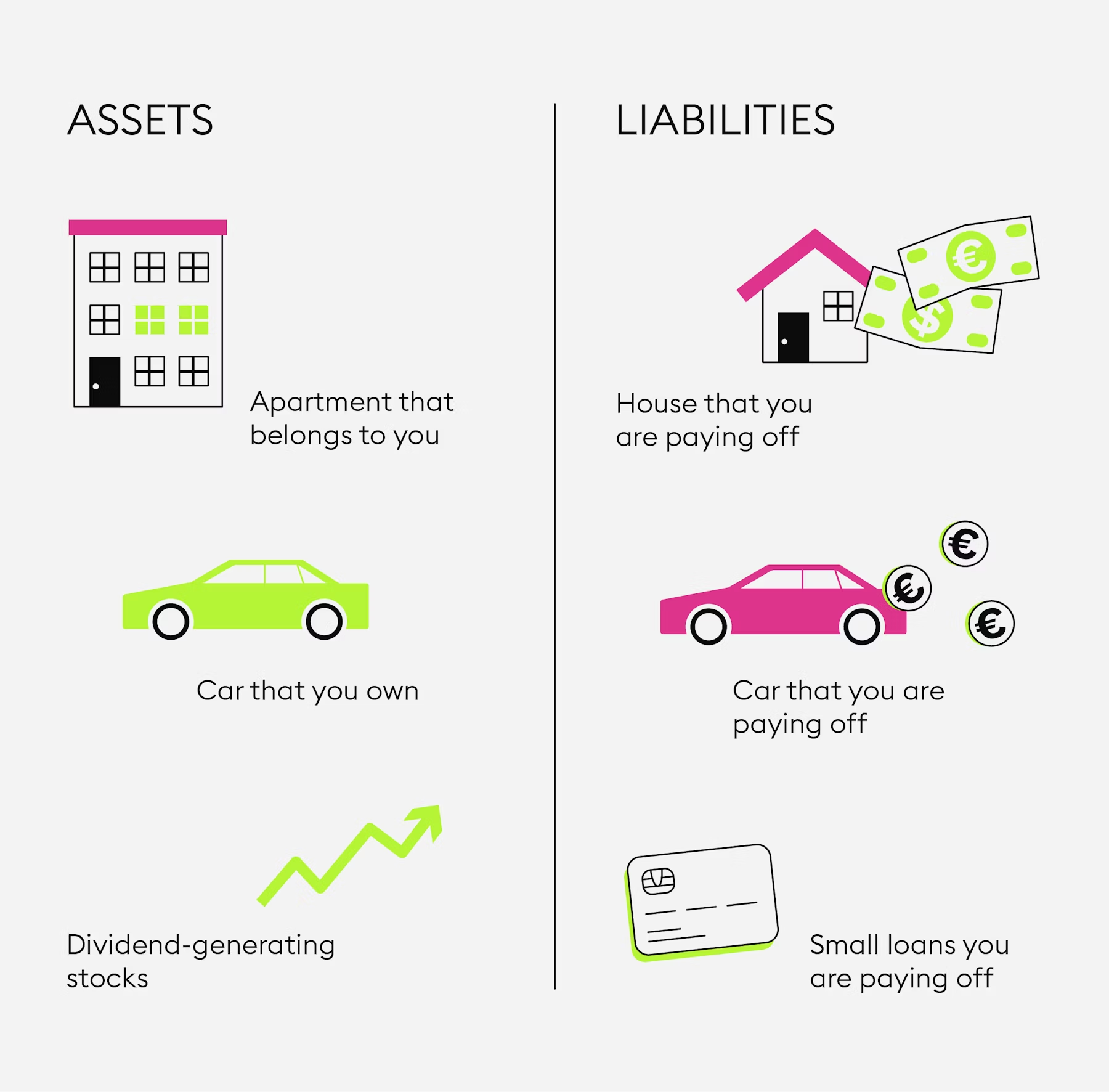

Like any other type from financing, Draw and you will Chloe would have to introduce a history of regular earnings enough to afford the loan. Their fico scores and credit score might be checked out plus its possessions and you will an excellent personal debt, nevertheless the financing recognition standards to have an FHA mortgage is much more flexible so you’re able to borrowers compared to standards to own old-fashioned resource.

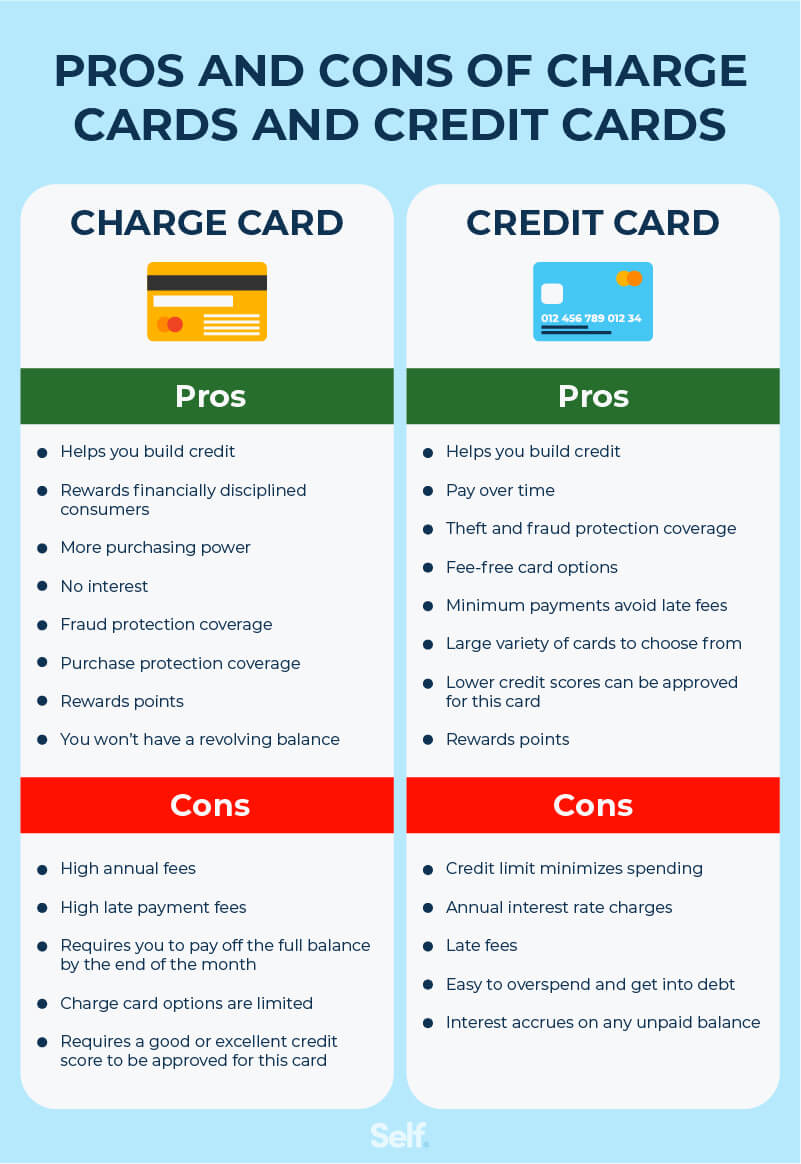

Positives & Drawbacks

Like any anything in daily life, FHA funding keeps each other pros and cons. Once we talked about a lot more than, it’s more straightforward to be eligible for the mortgage because a considerably all the way down down payment becomes necessary together with mortgage standards be a little more flexible of people with poor credit. A unique big advantage is the fact FHA covered loans try assumable. This is why if the Draw and you may Chloe intend to sell their household, the customer is also suppose, and take more, the mortgage payments. This might be an excellent advantage if your rate of interest with the newest financial is lower than the interest rates for new money.

FHA financial support has specific downsides. no wait loans Bayfield, CO A huge a person is the mortgage insurance fees (MIPs) one consumers need to pay. In fact, Mark and Chloe will have to spend two other MIPs in the event the they want to pull out an FHA covered financing. They need to pay an upfront home loan top during the closure comparable to 1.75% of your loan really worth. Instance, when the Mark and Chloe remove a great $150,000 financing, they will have to pay an upfront MIP regarding $2,625 in the closing or capable money it to your mortgage. Might also need to spend a periodic MIP that is additional on their monthly mortgage fee.

The fresh new FHA including imposes constraints for the characteristics of the house you to definitely be eligible for a keen FHA insured loan. The latest funds are merely available for primary houses. If you’d like to financing a holiday household otherwise investment property, you’re going to have to look someplace else. Simultaneously, fund is actually capped established where in fact the home is discovered. Such as for instance, when the ily household within the Minneapolis, MN in the 2015, a keen FHA mortgage try capped at the $322,000.

Fundamentally, the house must satisfy certain standards off quality that may require solutions ahead for the conformity having FHA conditions. If a provider will not make the fixes expected, the latest refusal usually prevent FHA funding.