A great assessment web site commonly split these off to you personally. Was our very own Plenti research publication or Canstar also provides complete comparisons.

Calculate the expense you know if refinancing will probably be worth it. The important aspects evaluate towards all signature loans are evaluation pricing, rates, application fee and loan label. Including enquire about leave costs should you wish to shell out the loan very early and you will standard and you may missed payment costs. The fresh new assessment speed will show that profile that encompasses the entire price of the borrowed funds you are researching.

What you should imagine

Throwing right up between home financing ideal upwards or a different sort of restoration financing? Remember one expansion with the home loan sometimes become offered repayment conditions into the new amount borrowed. When you are interest levels is all the way down, through the years the new outlay might end upwards are more. Which bargain brick bench greatest will most likely not end up being a great deal along with one appeal applied.

When selecting an alternative refinanced renovation financing you may thought secured personal loans rather than unsecured signature loans. You want assets to possess a secured financing, and they’ll should be really worth over the newest costs you might be combining. The risk is actually shedding the individuals property for folks who default, in case you make your repayments promptly then your award is gloomier interest levels to possess secured loans.

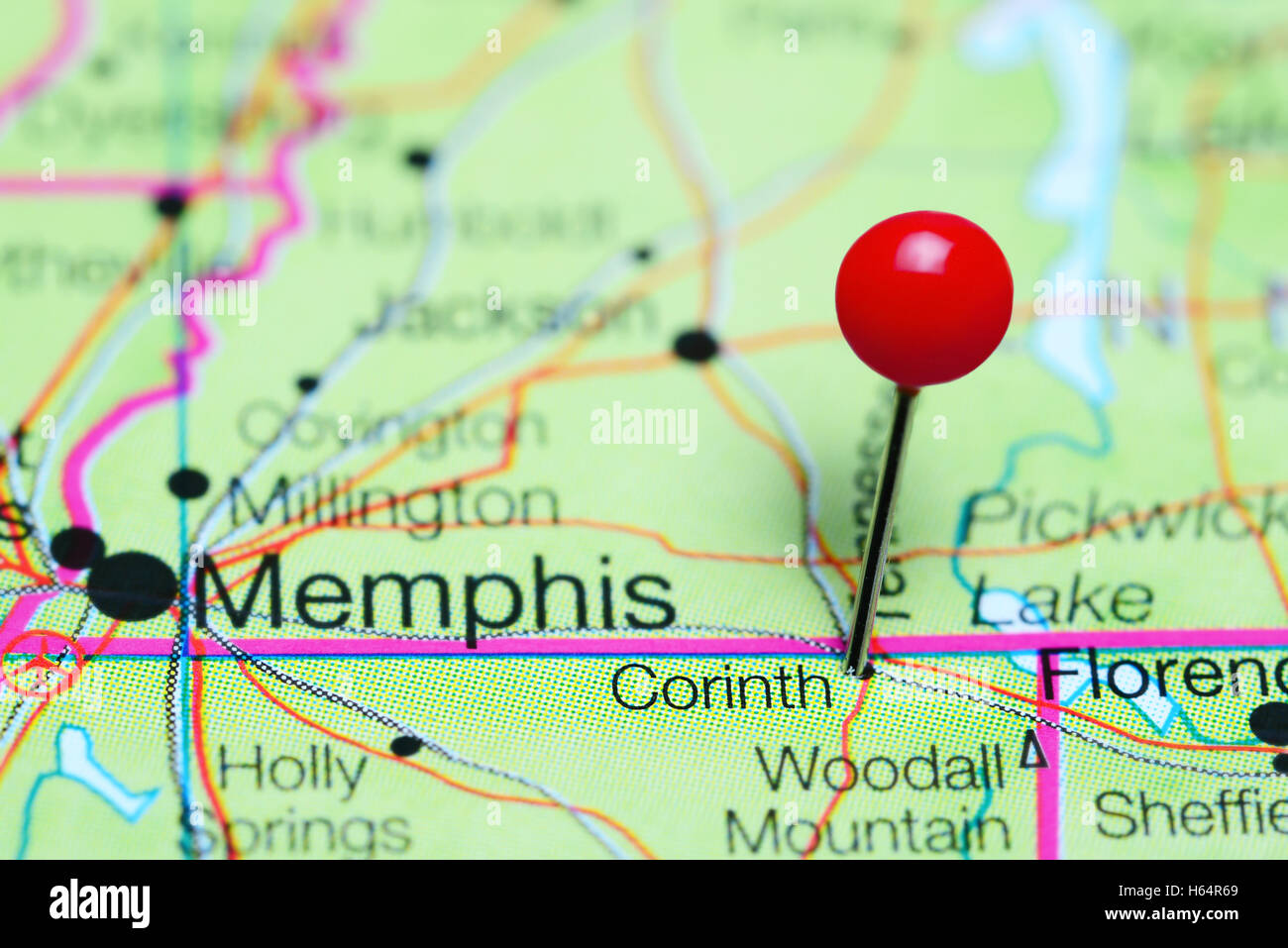

Have a think about fixed as opposed to variable prices. Fixed-price loans stay at the fresh quoted price into the full term so https://paydayloanalabama.com/cusseta/ you understand what matter you are paying every repayment day. Variable-price finance typically provides fewer restrictions and you may make more money to pay off your loan very early. Yet not, pricing which fee quantity is also change, fine if this decreases, high priced whether or not it increases.

Of many online currency loan providers also provide lower costs compared to large banking companies. If you like so you’re able to physically enter into a vintage bank, then they are not for you.

Just who provides re-finance recovery fund?

Credit Unions, old-fashioned finance companies, neobanks and online currency lenders is the give you an effective refinanced personal loan. Of several online-simply banks can offer mortgage which was personalized for you according to your credit score and you may/or financial history.

If you have already got several fund which have one to institution, this may be isn’t hard so you can combine to the you to. If you have a single consumer loan and wish to re-finance they having yet another throughout the exact same financial, it is easier to discuss an even more favourable rate rather than look at the entire process away from refinancing.

Think about my personal credit score?

That is a poultry otherwise eggs layout concern. Refinancing can get replace your credit rating, otherwise it might impression they in other quicker beneficial indicates.

Once you combine the handmade cards and you may funds to the one refinanced financing after that your rating often boost since you have less open profile. Following, for many who just create your money on time, anytime, their score commonly increase again.

Fortunately you can check your credit rating to own totally free through a registered agency including Equifax, CheckYourCredit and you may Experian.

Getting cautioned, regardless if, more this new funds your submit an application for, the more it will hurt your own get. Do your research, incorporate only for one which works for you immediately after which the rating may not be affected.

Requesting an individual RateEstimate having Plenti would not impact the rating while the its experienced a softer credit score assessment to help you give a speeds particular to you. If you up coming sign up for that loan, we submit a card query off Equifax and/otherwise Illion hence enquiry make a difference your credit score.