Personal loans will likely be a useful supply of more income when it’s needed. For example, for those who run into an urgent situation, you will possibly not have the money available to do the job. If you are planning a massive existence event such as for example a marriage, you might need a little extra dollars to finance they. In these cases and others, personal loans may come towards cut.

If you find yourself questioning just how a personal loan should be away from help that you know, we’ve generated a list of ways that signature loans can also be getting of good use.

step 1. They help you buy disaster expenditures instead of draining their savings

Life happens, and frequently you actually need access to disaster loans. Medical debts, car solutions, otherwise to buy a different sort of device may exceed or entirely fatigue the installment loans Nashville savings. That is concerning the, causing you to be prone to extra, unanticipated coming costs.

Taking out a personal loan helps you security the costs you will want to, causing you to be a cushion on your own savings.

2. It allow you to combine high-appeal obligations

For those who have credit card debt to settle, you’re likely accumulating higher quantities of interest monthly. In the event the interest try accumulating for the multiple handmade cards, its difficult to obtain before your debt.

Personal loans let you better manage your loans. You can borrow cash which have a personal loan and rehearse that it to pay off your own credit card debt. So it consolidates your financial situation, offers a predetermined payment monthly and you may keeps a keen avoid big date having when the financing could be completely paid.

On the other hand, you can usually see personal loans which have straight down interest rates than just credit cards. This allows one to pay your debt less and you can help save your money in the long term.

step three. One can use them to invest in your wedding day otherwise fantasy trips

Whenever life’s biggest events come up to, you may not continually be capable pay for just what you has actually dreamed of. Whether it’s your wedding day, vacation, otherwise fantasy vacation, unsecured loans helps you shell out the dough.

Once you take out a consumer loan, the term and rate of interest is fixed. Having a set amount to shell out causes it to be simpler to plan your own financespared so you can credit cards, with an effective rotating payment you to relies on how much spent, consumer loan costs are a lot a whole lot more foreseeable.

5. Personal loans was versatile within spends

Liberty is one of the most of good use aspects of an individual loan. Car and truck loans are for vehicles, mortgage loans is having homes, but unsecured loans normally generally end up being spent on basically something you want. Having less restriction provides borrowers the newest liberty to use the money how they you need if one to feel starting a corporate, financial support a marriage, otherwise merging loans.

six. They may make it easier to make your credit score

Unsecured loans may help create several aspects of your credit rating, as well as your borrowing from the bank blend the types of borrowing you really have currency lent on the, along your personal credit record, as well as your borrowing from the bank use ratio. When you first sign up for a personal bank loan, your credit score can get temporarily drop. But not, because you pay the mortgage punctually monthly, your credit rating commonly make.

You can be cautious, even when. Otherwise currently have very good borrowing, you might not manage to sign up for a personal bank loan which have an excellent interest. Large Annual percentage rate and you will charge is place you on a posture in which you can’t afford to pay off the loan, complete damaging your credit rating.

Understand that if you aren’t capable shell out their month-to-month costs, your credit rating commonly shed, beating your own brand new motives.

7. You can acquire large sums of money than simply a credit card

Based on your specific financial situation, your own playing cards could have relatively lower month-to-month constraints. This may allow it to be challenging to use a credit card to help you money highest instructions. That’s where a personal bank loan can come into the.

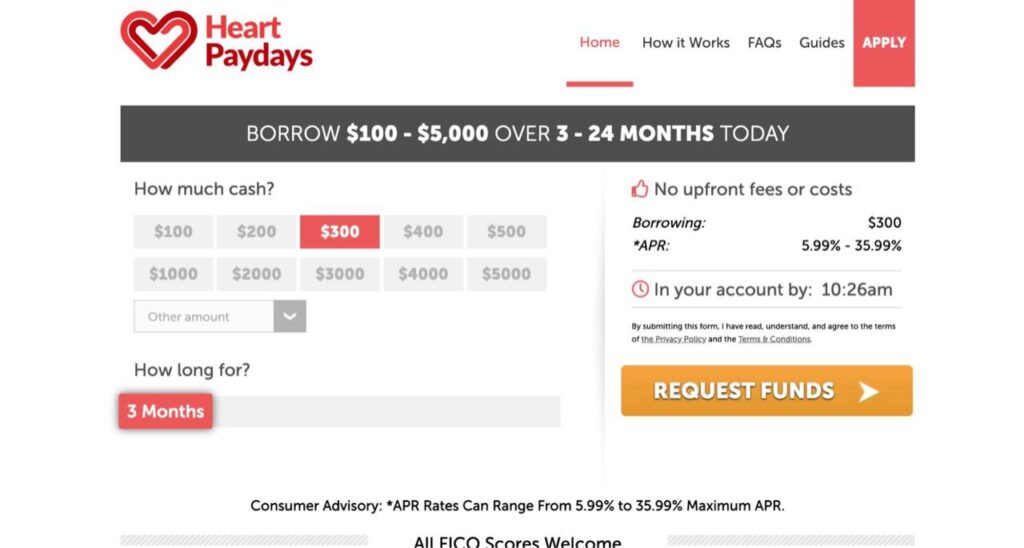

A personal bank loan ranges in number, constantly to $step one,100 so you can $ten,000. Although not, some loan providers may offer loans as small as $one hundred or as big as $a hundred,000. These versatile sums allow you to loans high costs than a card cards can get create, usually at the lower interest rates.

Discover more about Acquiring An unsecured loan

When you are trying to find learning a lot more about some great benefits of acquiring an unsecured loan, and how much currency you could potentially borrow that have that, you can check out our blog post with additional details about the niche.