For a property is qualified to receive a good USDA mortgage, it will meet up with the very first qualification conditions established by USDA, that cover outlying town designation, occupancy, in addition to physical condition of the home.

Thank goodness that of the nation is during just what USDA considers a qualified outlying town. But it is very important to prospective people to check on an excellent house’s qualification standing prior to getting too far to your processes.

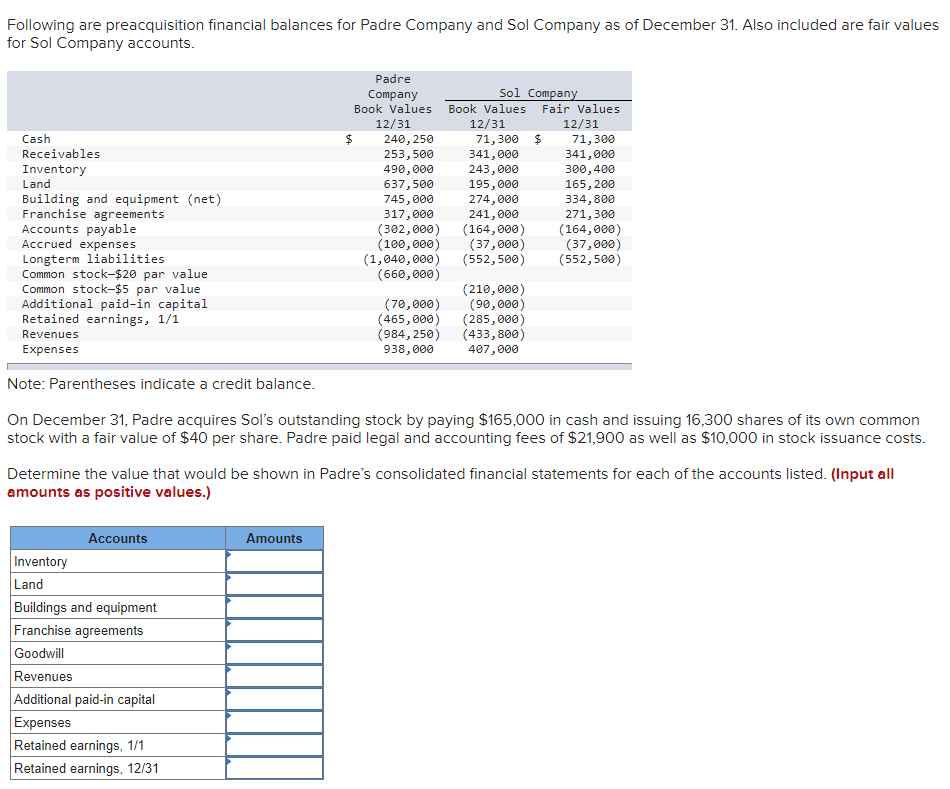

USDA Eligibility Map

You can use this interactive chart to aid know if an effective household currently fits the new USDA’s property qualification conditions. Areas in the red aren’t currently eligible for a beneficial USDA-recognized loan.

Property eligibility section can alter a-year and so are predicated on society proportions or other circumstances. So it chart try a useful publication, however the USDA could make a last determination regarding the property qualifications immediately after discover a complete application for the loan.

Should your prospective household drops close or in a location one will not seem to meet with the outlying designation, an effective USDA-accepted bank is also make sure the fresh new address from the USDA’s on the web webpage.

To confirm the target to own a beneficial USDA financing, it is best to talk to a great USDA-acknowledged financial. An effective USDA-approved bank normally ensure most of the functions you are looking for and be sure to never waste time towards qualities that can perhaps not qualify.

What is actually a great “Rural” Area?

To have a property to get to know the fresh USDA’s rural definition, it ought to be into the a place that’s located away from a good city or city and not in the an urban area

- A population that does not go beyond ten,000, or

- A populace that will not exceed 20,000; money loans Saybrook Manor CT is not situated in an urban statistical area (MSA); and it has a critical lack of home loan credit getting low- so you’re able to average-income family members, otherwise

- Any town that was once categorized while the “rural” otherwise a good “rural area” and you will forgotten the designation because of the 1990, 2000 otherwise 2010 Census can still meet the requirements whether your area’s society cannot go beyond thirty five,000; the bedroom is actually rural in character; and the area provides a life threatening insufficient financial borrowing to own low- and you can reasonable-earnings group.

These pointers try big in the same way that numerous short towns and cities and you may suburbs away from cities slip during the requirements.

Minimal USDA Property Criteria

The fresh USDA desires to make sure the family you select matches certain property conditions to guard the brand new borrower’s appeal and you may better-getting.

First of all, our home need to serve as much of your home. The good news is, of numerous assets versions are eligible for USDA loans other than purchasing a pre-established household, such:

- The fresh design

- Are manufactured or modular residential property

- Apartments and you may townhouses

- Small conversion process and you can foreclosed property

USDA loans cannot be useful for investment characteristics, meaning farms, rental otherwise trips property, and other money-producing characteristics are not qualified. But not, a house which have acreage, barns, silos etc which can be no more from inside the industrial explore might still meet the requirements.

Certain USDA House Conditions

New USDA requires the the place to find be structurally voice, functionally adequate along with a great repair. To ensure our home is within a resolve, a professional appraiser often examine and you will approve your domestic fits current minimal assets standards established in HUD’s Solitary Loved ones Casing Plan Guide.

- Accessibility the home: The house or property can be accessible from a flat otherwise most of the-climate street epidermis.

- Structurally voice: The foundation and you can household must be structurally sound on lifetime of your own financial.

USDA money features a separate assessment techniques than many other financing versions in the sense your appraiser try ensuring the house suits most of the standards set because of the USDA as well as deciding the new reasonable market value of the property. Remember that appraisals are not as with-depth since a property check.

Most other USDA Eligibility Criteria

On a single level of characteristics since the USDA property standards may be the USDA’s credit and you can earnings criteria. Given that USDA does not demand a credit score minimal, the application form really does enact income constraints, modified to own family members proportions, to make certain the money increase the reasonable- to center-earnings household that program was designed getting.

USDA earnings constraints number for the all adult family unit members, but will vary by the area and you can domestic proportions. The bottom money limitations is:

Once the UDSA property eligibility chart suggests a general thought of licensed places, it is best to consult a USDA lender so that the venue is obviously eligible. Simply because changes as to what the newest USDA considers eligible as the regulations and you will communities change.