Rebecca Betterton ‘s the auto loans reporter having Bankrate. She specializes in helping customers for the navigating the brand new intricacies out-of safely credit money to find a motor vehicle.

Marketer Revelation

We’re another, advertising-offered testing provider. All of our goal is always to help you make smarter financial behavior of the that provides entertaining systems and you will financial hand calculators, publishing totally new and objective articles, by the allowing you to carry out search and you can contrast pointers free-of-charge – so that you can make monetary behavior with certainty. Bankrate enjoys partnerships with issuers as well as, but not limited by, Western Share, Lender out of The usa, Financial support You to, Chase, Citi and watch.

The way we Make money.

This new also provides that seem on this web site are from firms that make up us. So it payment get feeling how and you will in which issues show up on it webpages, along with, such as for example, the order where they could come into the record kinds. But this payment cannot determine all the details i publish, or even the studies you select on this site. We really do not are the universe of enterprises or monetary now offers and this can be available.

Editorial disclosure:

Every studies are prepared because of the Bankrate professionals. Feedback conveyed therein are just those of your own customer and also maybe not started assessed or passed by people advertiser. All the info, and additionally prices and costs, showed in the remark try perfect by the time of brand new review. Browse the analysis towards the top of this site and also the lender’s site for the most newest guidance.

Without delay

- Access

Throughout the Navy Federal

- Variety of identity lengths. Navy Government has the benefit of over five payment terms and conditions, that have terms of around 96 months. So it wealth implies that you can favor a repayment alternative that suits your budget and requirements, with a maximum that’s a lot higher than simply that competitors.

- Reduced Annual percentage rate. If you are searching to find an alternative car or re-finance your current car finance, it’s also possible to be eligible for an apr as low as step one.79 per cent. This is notably below minimal Annual percentage rate of several most other loan providers.

- Vehicles Buying Provider. Thanks to TrueCar, Navy Federal’s Vehicle Buying Service lets you contrast MSRPs, discover rates even offers to the regional list and even have your automobile taken to you.

- Membership requisite. Automobile financing appear simply to those who qualify for Navy Federal registration: effective duty services professionals, immediate relatives, veterans and you will Company out of Cover teams. To become a member of Navy Federal, you must including maintain an effective Navy Federal family savings that have at minimum a good $5 equilibrium.

- Maximum APRs perhaps not announced. In the event Navy Federal keeps most low undertaking APRs, it generally does not list their restrict rates. When you yourself have poor credit, it is possible one Navy Federal is almost certainly not the least expensive choice.

- Limits having more mature utilized auto. Whenever you are used vehicles with 2020, 2021 and 2022 model age qualify for rates as little as dos.19 per cent, one automobile older than one otherwise people auto with more than 31,000 miles has actually starting costs of step 3.79 %.

That is Navy Federal best for?

A car loan which have Navy Government is likely the most suitable choice for military players in addition to their household, especially those that have a good credit score who can qualify for the a minimal pricing in the market. Additionally, it is a fantastic choice getting motorists trying to find high priced the cars; Navy Federal’s restriction amount borrowed are $five-hundred,one hundred thousand, definition you can drive out-of for the a brand name-the new vehicles because of the great features.

Kind of automotive loans offered

Navy Federal has the benefit of financing for new and you will put car, in addition to car loan refinancing. The loan amounts considering for new and you may used vehicles would be the exact same, falling ranging from $250 and you can $500,100000. Refinancing have at least loan amount out-of $5,one hundred thousand, however, Navy Government doesn’t specify a maximum.

For brand new car orders and you may refinancing a unique auto, you might choose an expression between thirty six and you may 96 weeks. To own car or truck commands and you can refinancing a beneficial used car, you could potentially choose between thirty-six and 72 weeks.

Rates and you will terms and conditions

In lieu of almost every other lenders, Navy Government cannot encourage a benefit for installing automatic payments. Their interest rate is determined by your creditworthiness, money and you can requested financing identity.

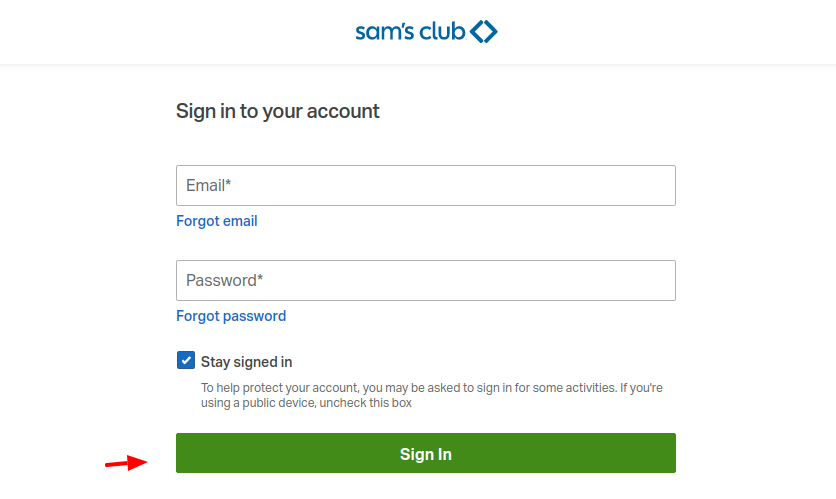

How-to sign up for a loan having Navy Federal

You could submit an application for a car loan which have Navy Federal on line, through the Navy Federal application, over the phone otherwise during the a part. More often than not, you really need to discover a decision within a few minutes out-of distribution your application.

- The contact number and you can email address (and people of the co-candidate, if appropriate).

- Your existing casing, employment and you may money pointers (hence of co-applicant, if the applicable).

If you have already selected an automobile or if perhaps you’re refinancing, you will need certainly to provide the vehicle VIN amount, the newest subscription county, the specific usage in addition to broker term.

Following acceptance, you are going to discover their sign in the brand new mail, or you can figure it out from the a Navy Federal part.

Car loan requirements

Navy Government cannot establish any credit otherwise money criteria. Although not, attempt to enroll in Navy Federal. You can qualify when you find yourself within the pursuing the kinds:

Customer care

Navy Federal has a few some other customer service choices for the players. User agents come 24/7 over the telephone from the 888-842-6328, or you can rating questions answered through an alive chat function on the website. If you prefer for the-people interaction, Navy Federal features 350 twigs in the world where you could cam face-to-face having a customer personal loans for 600 credit score care broker.