Limits: Potential improvements must be prices-effective – upcoming offers need to be more the price of advancements produced. Cost-energetic assessment and property energy review must be completed ahead of being qualified.

Homeownership coupons

Several other dismiss readily available through HUD is through the new Housing Selection Discount resident system. This option brings subsidies to own property by allowing people to have fun with promo codes on the purchase away from a property. This choice is bound to help you basic-time homebuyers just who already discover personal homes guidelines, along with individuals who see low-money requirements. For more information, contact your local Public Homes Service (PHA) .

Benefits: Licensed basic-time homebuyers may use Casing Possibilities Vouchers given that payment on a property and might discover monthly guidelines certainly homeownership expenditures. Some PHAs can offer a help offer having down repayments; that is highly determined by the latest company.

Limits: People acknowledged with the system may need to see specific earnings and you may work standards. Pre-advice homeownership and you can property guidance software must getting done also.

Desire protection software having customers

Mortgage repayments is priount of money borrowed from a loan provider, excluding attention or additional charge) and you can appeal (the price you have to pay into bank towards loan amount, expressed since a share rates). Interest protection software can aid in reducing the latter. You may want to be eligible for home financing Borrowing Certification, that gives you a taxation credit inside the desire paid otherwise special capital at the a lower life expectancy interest that reduces so it pricing.

Mortgage Borrowing Certificate

Once property pick, condition and you may local Houses Financing Providers offer appeal discounts programs you to definitely succeed licensed buyers that have limited income to use an income tax credit to have a fraction of their mortgage notice. not, the Irs limits the financing in order to $2,100 a-year. Nonetheless, you could claim your whole financial attention given that a keen itemized deduction. Delight consult a tax elite group for more information on brand new taxation effects of Mortgage Borrowing from the bank Certification program, that has been up to because 1984.

Limits: The application form may have pricey app costs, and there try money and domestic purchase price limits. The brand new Internal revenue service limitations make borrowing from the bank less impactful when you look at the large-cost-of-traditions components.

Many bodies apps may help first-time home buyers stretch their house research so you’re able to house which need a bit more performs. One particular program, the new FHA Section 203(k), causes it to be sensible to solve right up one fixer-higher. The requirements because of it FHA loan system take into consideration the limitations of several first-time people face, including not having enough spared getting a downpayment . In the event these software aren’t restricted to basic-time customers, the cashadvanceamerica.net alternative to payday loan fresh versatile standards cause them to most appropriate having a first-day citizen financing.

FHA financing program

A federal Homes Government mortgage will be an easily affordable choice for first-date home buyers while the qualification criteria are typically notably less rigorous for almost every other loan software. FHA loans is actually covered from the HUD’s Government Construction Government and are built to remind loan providers so you’re able to provide to borrowers who don’t features perfect credit otherwise significant upfront dollars.

USDA financing system

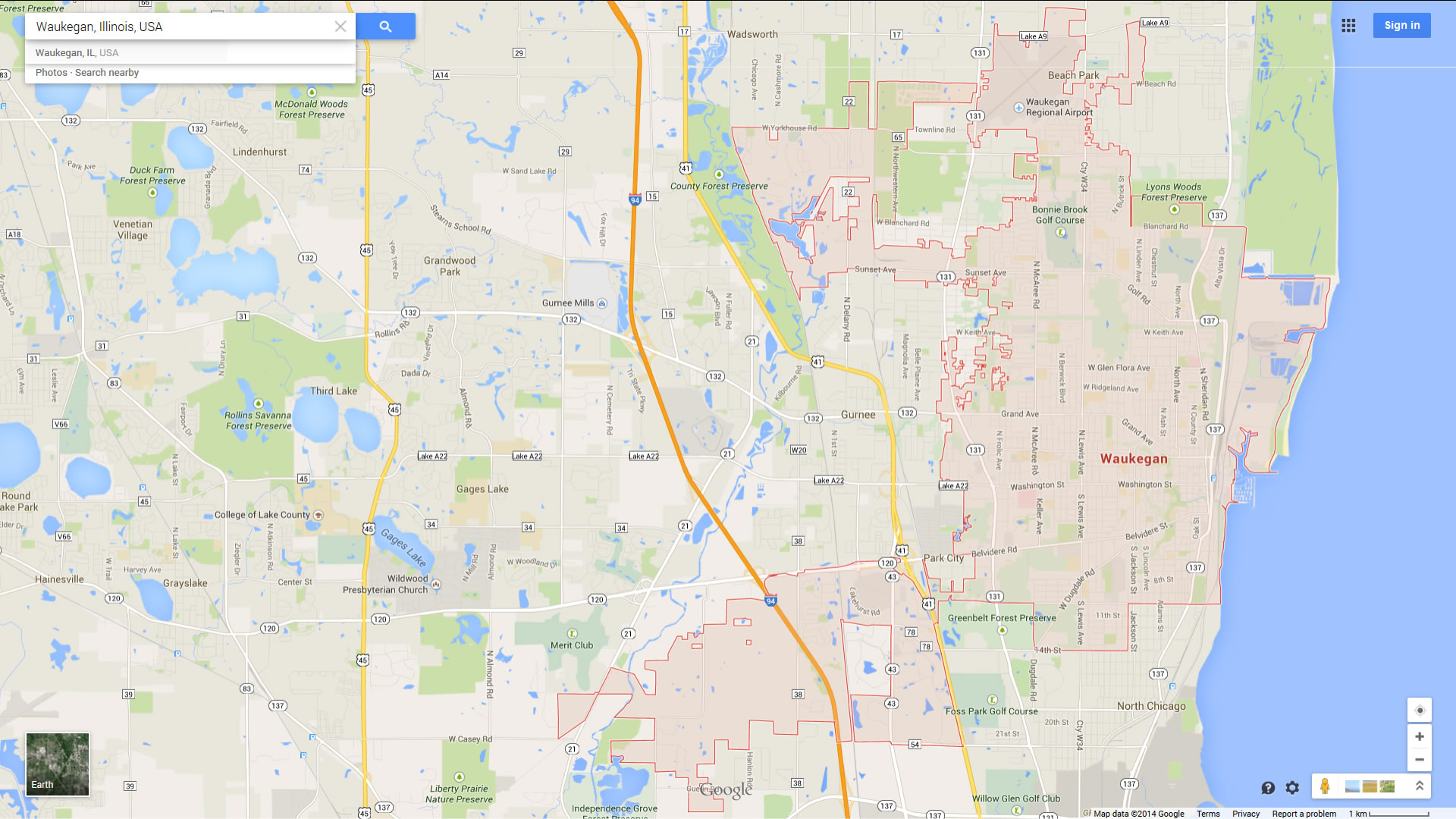

A beneficial U.S. Service from Farming (USDA) mortgage is actually a choice for consumers wanting house for the acknowledged rural locations, despite the intention to enhance harvest or boost animals. USDA finance are ideal for first-day home buyers with tight budget because they’re fully guaranteed of the USDA, which reduces standard concerns that lenders possess.

Va financing program

An excellent You.S. Institution away from Veterans Circumstances (VA) loan are an option for You.S. military users, including veterans, energetic obligation in addition to their family. Virtual assistant funds are backed by new Va and you may agents may help your from procedure for obtaining loan, otherwise render advice while you are vulnerable to defaulting into your mortgage repayments while the a primary-big date homeowner.