- DSCR loans : A loans provider coverage proportion (DSCR) loan is a superb alternative if you like in order to qualify for a mortgage without needing your tax statements. These financial are kepted the real deal house investors, too qualify for investment considering their DSCR, hence ways just how much move accommodations assets have compared in order to the debt burden.

These are just a few of the of numerous non-conventional or low-traditional loan choice that would be on the market. If you have questions about whether a non-old-fashioned financial excellent for your situation, get in touch with an expert right now to obtain the procedure started.

While shopping for applying for a home loan while the an excellent self-working individual, you ought to place your self on the greatest reputation you can easily to be approved. Probably the most crucial information that you should keep in mind are:

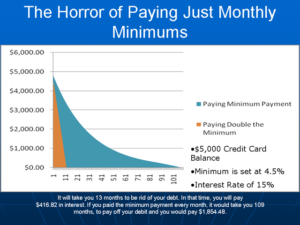

1. Lower Your existing Financial obligation

Once you sign up for a home loan, all prospective bank is just about to look at your i thought about this own established debt. When you need to maximize your chances of being qualified, try to reduce any current obligations that you features.

Several of the most well-known examples of personal debt tend to be bank card obligations, car and truck loans, and also figuratively speaking. For those who carry the debt to you toward application techniques, you may have a tough time getting approved. Just be sure to reduce as much of current financial obligation while the you’ll be able to before applying to have a mortgage.

dos. Lengthen Their Tax Background

When you get specific mind-working financing, you might be wanted your own taxation statements. In lieu of a great W-dos employee, a self-functioning personal will normally need certainly to give 2 years off self-a job record. Whether your earnings are steady on the individuals tax returns, you could potentially boost your likelihood of being qualified.

Whilst it will be hard to await several many years, it will make it easier for you to receive acknowledged in the event the you really have a lengthier tax history you could potentially promote near to the software.

step 3. Boost your Credit rating

Same as a traditional financing, your credit score is going to enjoy a critical character in the the program techniques. You need to make sure your credit history can be as high that one can before applying to own a home-employed financing.

- Proper people mistakes on your own credit file before applying having a home loan.

- Attempt to lower your credit application proportion and increase the amount from borrowing from the bank out there.

- Be sure to pay all of your expense promptly.

Whenever you max your credit history before you apply, you could considerably improve chances of qualifying.

cuatro. Offer And make a much bigger Down-payment

Remember that the lending company could well be examining simply how much away from good risk youre on them. For folks who show that youre prepared to make a larger advance payment, you could potentially enhance your odds of being approved as you will quickly slow down the chance your pose on bank.

Some someone highly recommend placing 20% down to possess property, you may have a simpler big date getting recognized when you’re willing to set-out a much bigger deposit.

5. Prove You may have Dollars Supplies

Whenever you are your earnings is important, the possessions are very important also. You will find disaster costs that develop occasionally, and when your demonstrate that you’ve got more cash supplies, you can raise your likelihood of being qualified. Like that, no matter if your revenue dries out up due to the fact a home-operating elite group, you will still have plenty of cash supplies you can slip straight back to continue to make mortgage repayments.