They give a quick and easy prequalification procedure and now have render small refinancing estimates compliment of their site. Although not, they luckily for us don’t give the customer care solely from the Web.

Reali features good concierge provider which can help you from the credit techniques out-of beginning to end. The process is paperless and you can transparent. Anyone who is even a little tech-smart have a tendency to become both familiar and comfy performing this. Probably one of the most difficult elements of mortgage credit is perhaps all of paperwork and you may shopping for missing data files to give towards the bank. The latest electronic system one to Reali brings will make it clear about what you have to submit. They also promote updates as to what you might be missing, you will not have the resource otherwise acceptance organized due so you can a misplaced document otherwise setting.

Lender out-of The usa

Are one of the greatest banks worldwide yes arrives which includes benefits you to almost every other institutions can not afford, particularly when considering financial financing. Bank away from The usa now offers multiple loan possibilities and you will highest-technical customer service.

Bank out-of The usa offers many choices off refinancing and get finance, plus varying-rates mortgages having 5/step 1, 7/step one, 10/step 1, and 15-, 20- and you can 29-season repaired-price finance. What’s more, it items bodies-covered financial facts such Experts Points (VA) and Federal Casing Management (FHA) loans also jumbo loans to $5 million.

Financial regarding America has several programs which can be designed to generate homeownership economical for basic-some time and straight down-money homebuyers.

- Doing $7,five-hundred during the lender borrowing for costs particularly tape costs and label insurance

- Up to $ten,000 to summarize costs and you will down-payment direction

- Several financial items that have step three% lowest off money: the fresh new Freddie Mac House You can home loan and also the Sensible Loan Services home loan

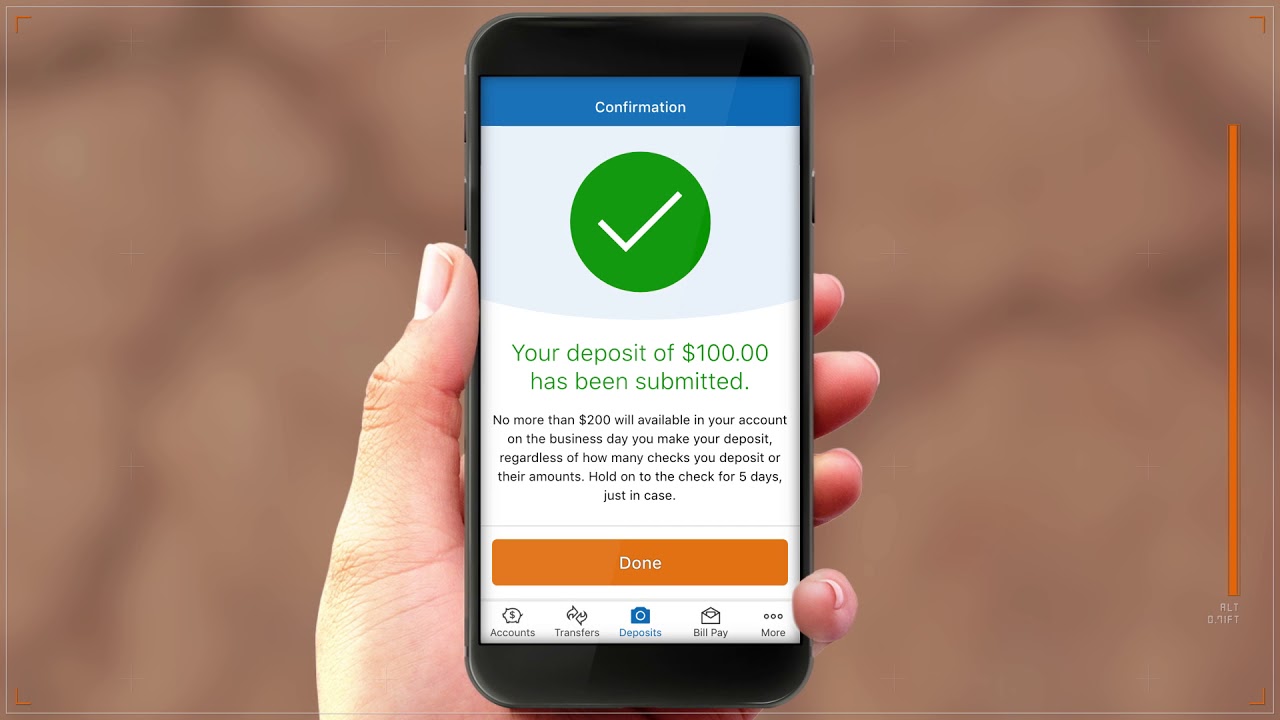

This new electronic mortgage sense from Lender off America enables you to implement, score prequalified, and also have protected your interest on line through its cellular application or site. You could also be capable of getting preapproved on the same date which you use. If you find yourself a financial out-of The united states users already, in that case your monetary investigation and make contact with pointers have a tendency to vehicles-populate towards electronic application, thus saving you day. You are able to https://paydayloanalabama.com/ethelsville/ pertain inside-people or over the device in the event that’s something that you would rather. The home Mortgage Navigator webpage out-of Financial off America helps you remain plugged in about borrowing from the bank techniques.

Secured Price

You are able to down payments each month with an intention-merely financing than simply which have a normal, antique loan. However, to get one straight down percentage, you do not make any improvements into the paying down the primary and you may building guarantee in the home. As a result of this, interest-merely fund usually are not a suitable solution.

When you need to apply for a destination-only mortgage, you can check aside Protected Price. That it home loan lender have acutely highest customer happiness while offering interest-merely mortgage loans throughout 50 states and Arizona, D.C. Just be sure that you are familiar with the downsides interesting-just fund before applying for example.

Busey Bank

Busey Lender is a significant mortgage lender based in Saint-louis, Missouri. Which financial brings conventional Midwest providers pleasure using their prize-successful customer care score. It also have practices in the Illinois, Missouri, Florida, and you can Indiana.

Busey might not be the largest bank around, nonetheless bring various adjustable and you will repaired loans given that well given that money through the Va and you can FHA home mortgage software. The history of Busey financial goes back so you can 1868, making it one of many longest existing lenders on this subject checklist.

PennyMac

Even in the event PennyMac actually regarding the large lenders Fannie mae and you can Freddie Mac computer, will still be a name you really need to probably know if you are searching for an FHA financing having a minimal downpayment. PennyMac try a direct bank, and are generally mainly an on-line-centered lending institution.