Key Takeaways

- An FHA financing are a national-supported mortgage which is insured because of the Government Housing Management.

- A normal loan is actually home financing offered by personal lenders sans any head authorities backing, which means unlike FHA money, they may not be guaranteed otherwise insured of the regulators.

- Compared with traditional fund, FHA finance are less limiting of credit rating and you may off fee requirements.

People who attempt to enter the market may you prefer financing will eventually to do this, and you will facts a person’s financing possibilities will help be certain that compatible words. Exactly what is the improvement? Continue reading for FHA versus. conventional fund to help make the best choice.

What exactly is a keen FHA Loan?

Government-recognized financing requirements are usually shorter tight than for conventional loans, while some political providers expose their own eligibility criteria.

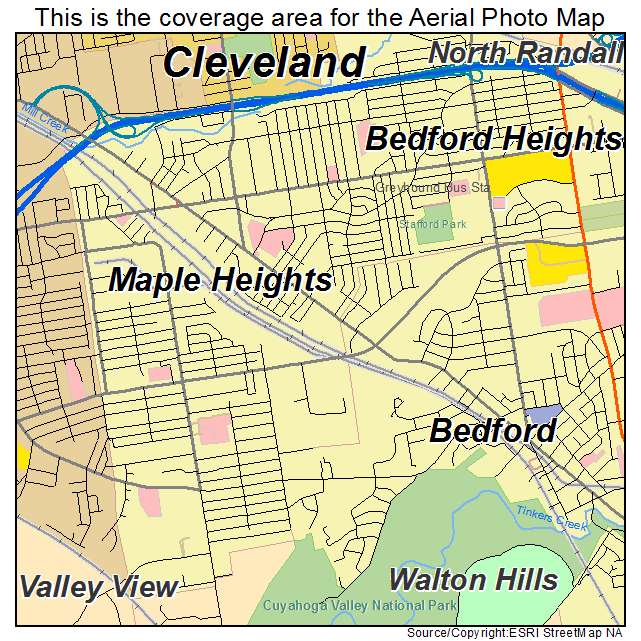

Yearly, new mortgage limitations are centered with the FHA money. Although not, including limits are different based on in which in the united kingdom a property purchase are found. Such as, the top restrict for the lower-pricing areas such as rural Missouri is $472,030, since upper limitation when you look at the higher-prices areas, say, Tangerine Condition, Ca, is $1,089,300.

To search for the upper limit during the your state, the simplest way is via going to the You.S. Property and you can Urban Development’s site to have FHA mortgage limits. Observe that searching for an enthusiastic FHA financing as opposed to a conventional you to means like mortgage constraints you can expect to limitation the level of domestic one can eventually pick.

What’s a normal Mortgage?

A conventional financing try home financing that’s given by private lenders sans one direct authorities backing. Consequently instead of FHA money, antique funds commonly loans Silverthorne guaranteed or covered of the regulators.

Old-fashioned finance are classified as both compliant or nonconforming. To the former, financing standards try situated by federally supported financial associations Federal national mortgage association and you will Freddie Mac computer. Like loans may not exceed brand new conforming loan restriction, that’s $726,two hundred having 2023, with highest-rates portion from the $1,089,300.

Along with Washington, D.C., high-prices parts can be found inside the Ca, Connecticut, Texas, Georgia, Fl, Idaho, pshire. they are present in Nyc, Nj-new jersey, New york, Tennessee, Pennsylvania, Wyoming, and you may Western Virginia.

Nonconforming financing, normally jumbo funds, are provided to prospects just who seek to purchase property you to definitely is higher than conforming mortgage limits. Observe that due to their size, jumbo fund routinely have stricter underwriting recommendations.

As with FHA money, old-fashioned finance would be possibly repaired-price or variable-rate mortgages. Old-fashioned loan conditions can vary regarding eight so you’re able to 3 decades.

FHA vs. Antique Loans: Credit history

Whether or not one to is applicable to own an enthusiastic FHA otherwise conventional financing, their credit history would be examined. Lenders utilize the rating to assess risk.

Weighed against antique fund, FHA finance are often less strict off credit score criteria. Old-fashioned fund and additionally basically require a lower loans-to-income proportion.

A conventional mortgage essentially needs the very least credit history out of 620. If a debtor is applying alone, the financial institution tend to take into account the average get out-of around three biggest credit bureaus: Experian, Equifax, and Transunion.

If your software program is that have a unique borrower, the brand new score you to loan providers essentially believe is the mediocre average rating. Like, if an individual borrower has actually a median get of 720, therefore the co-borrower’s average score is actually 580, Fannie Mac often mediocre the two numbers, landing during the a rating of 650.

You will be able for someone that have a credit history as the lowest just like the five hundred in order to be eligible for a keen FHA home loan. But not, the fresh new candidate need to assembled a good ten% down payment. A guideline is the fact that the higher your credit history, the reduced the desired down payment.