Understand that you ought to is income out-of whoever lifetime along with you on your latest life arrangement, even if they will not be on the borrowed funds. Some situations away from more income would be:

- An operating adolescent decades 18 or more mature

- A parent-in-laws just who gathers societal safety

- Your own wife or husband’s front side providers

- Gig functions or contractor earnings

Make sure to allow your lender know about all the sources of income upfront since you desire to be sure you are entitled to an excellent USDA financing after you generate an offer with the property.

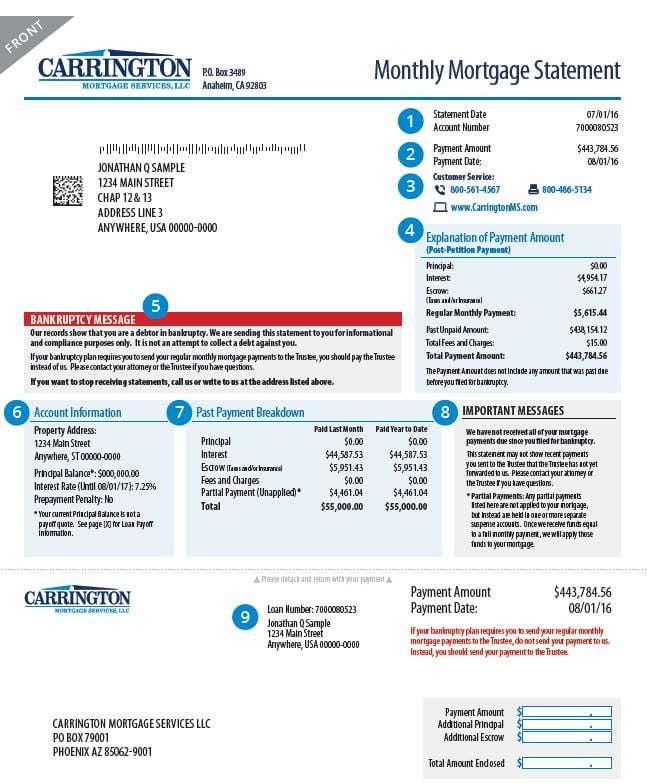

Youre permitted to build a downpayment if you need. not, it is smart not to ever generate a down payment and sustain you to money in the bank to own issues.

You will you would like on 2-5% of the house’s rate to own closing costs. Thus, dont to go all of your current cash to help you a down-payment.

USDA advantage limits to possess 2023

There’s a limit to help you personal property. This is because USDA would like to put aside the application form for these just who can’t be eligible for a traditional loan.

- Lack of low-old-age loans and also make an excellent 20% down-payment and buy settlement costs

- If you have this type of loans, you really need to have shortage of money to attain a 28% homes debt-to-money ratio and you can an effective 36% all-inclusive financial obligation-to-income proportion having a good 20% down payment

Most USDA individuals enjoys no place close this amount of assets, making this generally speaking an easy guideline to meet.

USDA financing constraints 2023

There are not any difficult-and-timely mortgage restrictions into Protected USDA loan program. You are eligible for one loan amount you could be considered getting. The bedroom money limits try to be financing restrictions in such a way.

Such, in the event the income is precisely at the restriction for many elements of the country, you’ll generate $103,500 per year or $8,625 four weeks.

Therefore, whenever you are USDA will not restriction loan quantity, it can restriction money, and therefore ultimately hats extent you’ll be eligible for. The maximum obligations-to-money getting USDA loans is just about 41%, but could be high for certain consumers. Different people commonly be eligible for an alternative limitation loan amount created on the earnings, mortgage rates, other debts, credit score, and a lot more.

USDA mortgage financial prices

USDA mortgage rates are some of the lowest of every program. This is exactly stunning, offered he is a zero-off mortgage that is and additionally easy toward fico scores.

The application is actually greatly paid of the bodies so you can remind homeownership and you may economic hobby in the portion outside huge metropolises. Therefore the federal government bags hefty pros towards the program, like reasonable pricing.

USDA property updates and you may trait recommendations

The reason for the new USDA program is to try to offer households that have modest casing that is secure, sanitary, and will hold the high quality and value towards near future.

Truth be told, current belongings within-crushed swimming pools qualify having USDA financing. But not, you simply cannot create a pool and other deluxe business such outdoor kitchen areas with a great USDA framework otherwise treatment loan.

As far as possessions standing, the same advice are used for FHA finance. This is why all of the biggest assistance particularly heat, liquid, roof, and you may stamina must be working. If there’s any question from the a primary program otherwise a defensive matter, brand new appraiser usually note they on the assessment statement. The lender might need an extra assessment in such a case.

For almost all points, the new appraiser need brand new fixes before mortgage closure. Manage the real estate agent to obtain the vendor build the new repairs as fast as possible.