For almost all ambitious property owners, selecting an inexpensive path to homeownership feels particularly a distant fantasy. HomeReady money is a different sort of and versatile home loan alternative built to get this to fantasy possible getting a wide listing of some one and you can families.

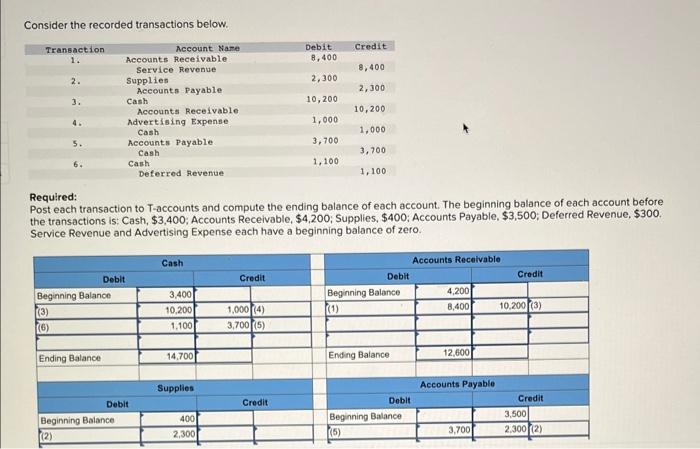

Just what are HomeReady finance?

HomeReady is actually a specialized mortgage program given by the latest Federal Federal Mortgage Association (Federal national mortgage association), among the regulators-sponsored enterprises (GSEs) that encourages the means to access reasonable mortgage resource in the us. It assists earliest-big date homeowners (FTHBs) and lowest-to-moderate-earnings individuals in finding their dream about achieving its dream of homeownership. It permits consumers to utilize cash on hands for the exchange, while most other loans wanted money getting traceable or experienced to possess no less than 60 days.

Beneath the system, qualified possessions systems is that-unit priily home, townhouses, condos, and prepared unit improvements (PUDs). While doing so, are formulated construction qualifies which can be capped from the that loan-to-value proportion regarding 95%. it allows for consumers to find a finite cashout refi opportunity to utilize their house’s equity.

One to known change away from a good HomeReady system is actually their versatile money constraints, being in line with the property’s location together with borrower’s city average income (AMI). This particular aspect is useful having borrowers remaining in portion with high property costs, whilst . In contrast, applications eg FHA provides fixed-income limitations, probably limiting qualification for the majority individuals in the high-rates nations.

HomeReady eligibility conditions

An excellent HomeReady system also offers attractive conditions and advantages to own low to help you moderate-income borrowers. However, like most mortgage program, referring having eligibility standards having prospective residents. You must meet with the after the HomeReady loan restrictions.

80% city average income (AMI):

One of several basic qualifications standards getting HomeReady is the money. Your income cannot go beyond 80% of your own AMI towards precise location of the property you plan to invest in. This requirement ensures that HomeReady priilies which have modest incomes, while making homeownership accessible in components with varying pricing-of-life style standards.

620 credit history:

Regardless if HomeReady try targeted at reasonable-income individuals, you’ll want a qualifying credit history. If you find yourself conventional money may have stricter credit history criteria, HomeReady it allows fico scores as little as 620.

Homeownership education:

Fannie mae means HomeReady consumers to accomplish an internet homeownership knowledge path. That it training component helps individuals most readily useful understand the obligations out of homeownership, cost management in addition to homebuying process, guaranteeing he or she is better-open to to acquire a home for the first time.

HomeReady professionals

HomeReady finance stick out since an appealing choices and their several masters that lay all of them besides other choices. You to definitely key advantage is the reduced lowest downpayment element only step 3%, rather less than of several traditional FTHB financing consult.

Essentially, a lower life expectancy advance payment tends to make homeownership far more available for folks and family members, specifically those that have limited discounts. Permits these to go their homeownership desires with reduced upfront prices.

Additionally, its self-reliance during the income calculations and borrowing standards makes HomeReady a great versatile option you to address exclusive economic circumstances regarding a wide directory of individuals. Due to the fact a choice, it includes lowest-income consumers having a very clear path to homeownership and offers the latest following pros.

Low down payment criteria – 3% minimum:

One of the first traps so you’re able to homeownership for most borrowers is the problem away from saving a substantial downpayment. HomeReady’s low-down commission criteria, as little as step 3% of your own residence’s price, helps make homeownership alot more accessible. Borrowers can also be enter the housing marketplace having shorter upfront dollars, that’s specifically very theraputic for people with restricted offers.

$dos,five hundred borrowing from the bank to possess advance payment and you will closing costs

To deal with best traps in order to homeownership HomeReady money today tend to be a beneficial $dos,500 borrowing getting off payments and you will settlement costs to possess very low-income buy (VLIP) consumers. Consumers with a qualifying earnings out-of lower than or equivalent to 50% of your applicable area median earnings (AMI) of your own topic property’s place meet the requirements. Speak to your Mortgage Administrator having qualifications.

Earnings flexibility:

Constantly, income accounts vary notably because of the place. HomeReady takes into account the newest borrower’s money Holyoke loans when considering the newest area’s median income. Consumers need to have a living that doesn’t exceed 80% of the area median income (AMI). Because of this, borrowers with reasonable revenue , inside highest-pricing casing locations.

Qualifying money is sold with boarder money:

Lower than HomeReady financing recommendations, local rental income from anybody leasing ancillary house gadgets otherwise boarder in the brand new borrower’s number one household is viewed as while the qualifying income.

Fixed-Price (FRM) and Variable-Speed Home loan (ARM) options:

HomeReady allows you to choose from FRM and Sleeve. Borrowers go for the soundness regarding a fixed interest or perhaps the initial lower desire loan cost normally on the Fingers.

All the way down financial insurance costs:

HomeReady has the benefit of faster personal mortgage insurance (PMI) superior versus fundamental antique funds having low down payments. The reduced home loan insurance fees lead to inexpensive monthly mortgage repayments. Moreover, mortgage insurance is cancellable when the borrower’s equity is higher than 20%. PMI is generally got rid of each FNMA Upkeep Guide coverage (limitations pertain).

Buy and cash-Aside Refi offered:

HomeReady supports both family purchases and you can restricted bucks-away refinances which have an optimum financing-to-well worth (LTV) proportion as much as 95 per cent. This is why individuals can access the residence’s security to pay for some expenditures or consolidate debt, it is therefore an adaptable choice for those individuals trying refinance the established belongings. Consult your lender for the requirements and you will constraints.

Debtor assistance:

HomeReady makes it possible for the fresh introduction out-of low-debtor, non-renter money when you look at the deciding the debt-to-income (DTI) proportion. That it autonomy can be helpful to own borrowers who wish to enlist the help of family relations to be eligible for the loan. On top of that, permits nonresident co-borrowers for people that have handicaps.

Closure viewpoint

Collectively, these features highlighted more than try to remove barriers, provide monetary freedom and you will bring informed from homeownership easily through the use of this program. Talk to a qualified bank from your bank or borrowing from the bank commitment to decide their eligibility and you may speak about exactly how good HomeReady renders your homeownership dream an actuality.

Practical account and credit certificates incorporate. All the loans susceptible to last borrowing approval. Rates and you can terminology was susceptible to change without warning and so are influenced by borrowing performance. Visit Ent/Court to examine Ent’s Very important Mortgage Suggestions and Disclosures.

Funding available on home in Texas. Assets insurance policy is called for. Request a tax adviser for further information regarding deductibility interesting and charges.