To buy a home has many positives. It isn’t just a threshold americash loans Hollis Crossroads more your face. A home can also are designed to become an admiring and real asset as you are able to leverage to reach some other economic specifications within more existence stages.

Some of the options for capitalizing the fresh hidden value of their home were partly or totally leasing it, promoting it, otherwise proper-sizing to some other assets. Naturally, this type of instances require you to to change your own life style plans.

Although not, you will find an option enabling that accessibility your own property’s guarantee rather than diminishing their way of living agreements, in fact it is a house guarantee mortgage. I identify right here just how property collateral mortgage works inside Singapore and you can preciselywhat are the pros and dangers.

Do i need to boost my family equity?

The worth of your property equity is highly determined by this new market value of your house any kind of time point in the long run. Progress in home equity you will come from:

- Settling the principal equilibrium of your house mortgage. So it decreases the personal debt your debt towards the financial and you may grows your guarantee possession of your home.

- A rise in the fresh new enities in your area, instance yet another MRT line, universities, malls, or parks. You could potentially strategically get a home which may has such an excellent changes of the studying town master preparations.

- Renovation and you will repair smartly according to certain products on the neighborhood like gentrification or design trends that notice upcoming renters. Yet not, you’ll have to plan for the price of the new restoration and imagine its return on investment. Observe that this may be far more applicable so you can upscale personal properties, like arrived residential property and deluxe condominiums.

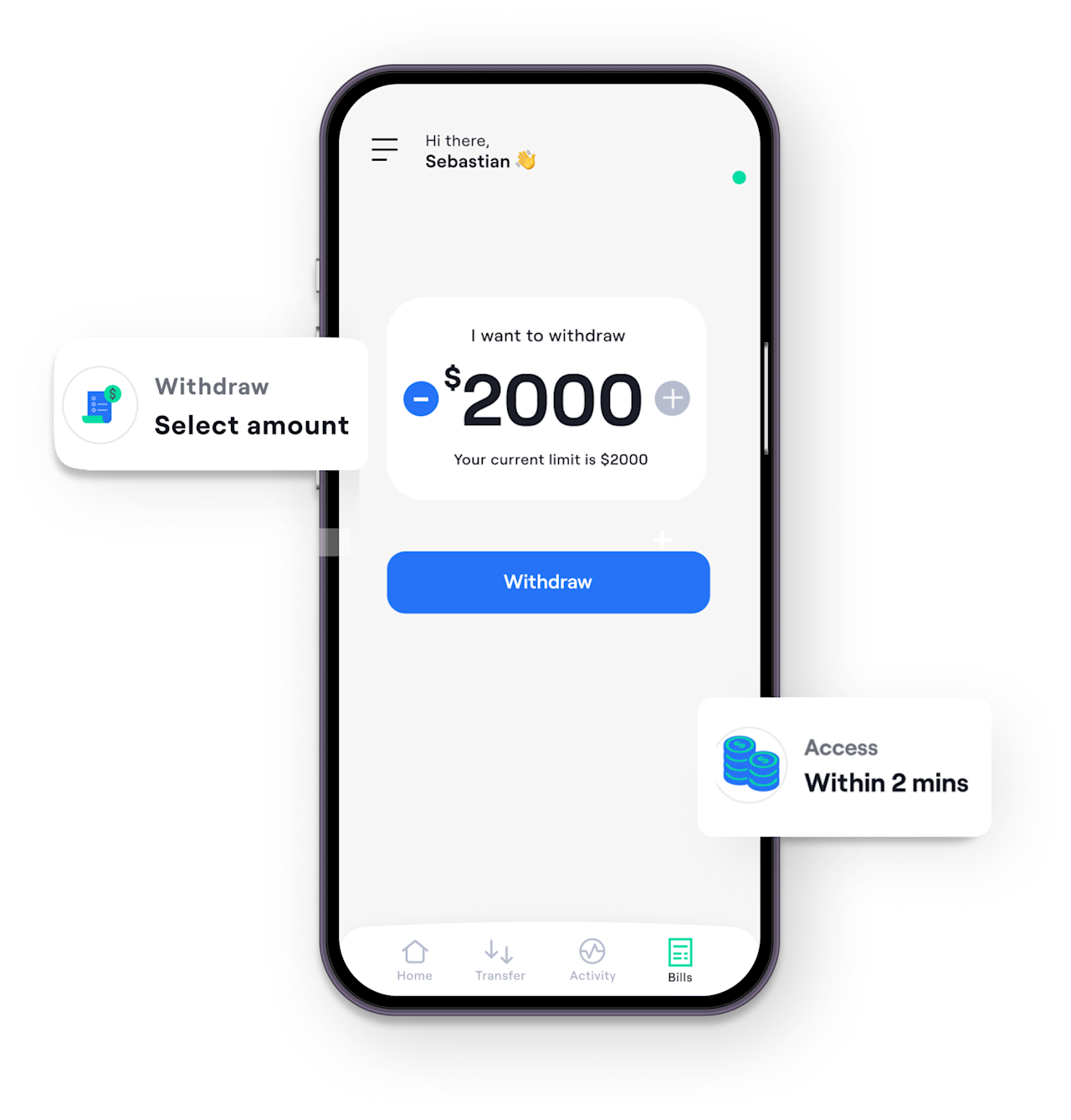

Loan providers when you look at the Singapore, lower than certain laws and you can assistance, offer financing from the equity you hold in your assets. House collateral financing was a secured mortgage where your home is utilized while the security into the financing. Residents will benefit throughout the like of your own attributes and you can obtain finance protected resistant to the property to finance their almost every other financial need including studies.

Why: property collateral loan compared to. offering or leasing

In the example of partially renting your property, you might have to live with a complete stranger and you can comply with the changes which may feature it.

For many who sell your home otherwise rent it fully, as well as the frictional hurdle of swinging your land, there’ll be the additional exposure and you may will cost you away from leasing otherwise to order a different destination to reside in. In the case of exchanging, discover numerous fees, taxation (like stamp commitments), and you can pre-fee punishment (on the a good loan, when the appropriate that you must thought.

When it comes to a home collateral loan, you’ve got the went on advantage of located in your residence when you’re gaining access to a hefty part of the value of the household in the dollars. Trying out a house equity financing incurs the speed billed by the bank, together with responsibility to spend back the mortgage quick. Unless you pay back the borrowed funds instalments promptly otherwise otherwise standard on your own personal debt according to the loan, the lender get promote the newest mortgaged assets to recuperate the brand new outstanding number underneath the loan.

Why: property security financing compared to. an unsecured loan

Based prevailing sector conditions, a house collateral financing may have mortgage lower than a personal bank loan. In the case of a home security financing, its a protected mortgage to the possessions being the cover, for this reason letting you see a lower life expectancy interest rate. Do remember that if you do not pay-off the borrowed funds instalments promptly if not default on your financial obligation according to the financing, the effects vary away from late fees, adverse impact on your credit score and odds of a foreclosures within the terrible situation circumstances.