, has made a couple of HUD 184 finance, both for the development of the latest property toward Flathead Indian Reservation from inside the northwestern Montana. Assistant Vice-president Milanna Atwood, who is the newest bank’s a home credit manager, told you it was not difficult to romantic the fresh new finance which these people were normal of any sort off bodies-verify program. Atwood labored on these types of financing on the HUD’s Office of Indigenous American Programs, based in Denver, and she receive the staff useful. Valley Lender of Ronan put a first-go out home buyers system supplied by the latest Montana Panel of Casing (MBOH) inside the scam, the new customers received 25-year finance that have an effective 6 per cent interest rate. The financing was indeed after that ended up selling so you’re able to MBOH, therefore the bank left this new servicing portion. Atwood mentioned that the lending company would like to build far more HUD 184 loans, detailing that “This choice is helpful due to the fact a lender are available the brand new finance for the additional business while not having to keep them to the the instructions.”

This new second field

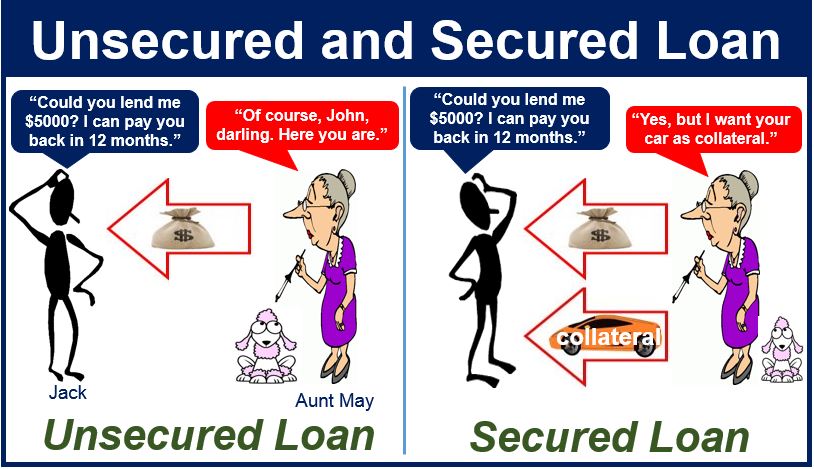

By defects of fabricating mortgage loans within the Indian Nation, such as funds used to be felt unsaleable. So it implied that the financial are faced with one or two possibilities: maybe not making the loan otherwise keeping an extended-term house toward their instructions. But not, the means to access the new supplementary market is key to while making mortgage loans as the offered to the reservations since they are on the rest of the country.

HUD 184 funds are purchased of the, certainly most other groups, the fresh Federal national mortgage association (Fannie mae). Considering Ken Goosens, providers movie director for Native Western financing programs in the Fannie mae, sales of HUD 184 funds have raised in the past five years. Toward a nationwide base, Federal national mortgage association provides bought more 3 hundred HUD 184 money, working with 52 people in sixteen claims. From the Ninth Federal Set aside District, Fannie mae possess bought throughout the 60 fund.

This attractive household into Fort Berthold Indian Booking was the fresh new very first domestic financed from the Northern Dakota Property Money Agency’s HUD 184 real estate loan system commitment.

Imaginative partnerships

To help expand the effective use of brand new HUD 184 financing program in the brand new Northern Flatlands, a nationwide mortgage lender and you will your state construction power have each molded partnerships made to clear up financing handling.

In a single partnership, Norwest Financial for the Southern area Dakota together with Aberdeen BIA urban area place of work work to each other to slice off administrative delays you to definitely frustrate lenders and increase the purchase price each transaction.

Predicated on Jones, the brand new BIA’s area manager, “It simply are as simple as attaching new label standing report, hence consisted of the latest court breakdown, to your mortgage application. Prior to, most of the court meanings had been had written onto the app, and mistakes took place, and this lead to applications becoming sent back and you will ahead between your city BIA workplace in addition to federal BIA place of work.” She shows you, “When you manage rural land transactions, legal descriptions get long and you can errors would happen. With the real judge dysfunction linked to the app, we rescue a few procedures.” The method, scheduled to start while the BIA when you look at the Arizona, D.C., has acceptance, should dramatically reduce the go out working in approving a great HUD 184 financing.

In another commitment, new Northern Dakota Homes Financing Company (NDHFA) have teamed which have Federal national mortgage association and you may an area bank to attenuate the amount of handling necessary for the financial institution. NDHFA ‘s the earliest homes funds institution in the nation to indication a contract with Fannie mae enabling this new department to market and you can solution HUD 184 finance actually.

An important person in this package-of-a-type system was Patrick Fricke, the fresh agency’s executive movie director. Fricke and his awesome employees acknowledged problematic stayed on the beginning off sensible outlying housing, therefore, the institution composed a good airplane pilot program inside the 1992 known as App Operating Service. Getting a fee, the brand new agencies tend to deal with the mortgage process from start to finish: underwriting, preparing the mortgage-closing documents and you will planning the borrowed loans in Wallingford Center funds available into secondary sector. The lending company takes the original software and closes the borrowed funds. By the handling Federal national mortgage association, the fresh new agency functions as a great conduit for the supplementary marketplace for small loan providers. Fricke claims, “Lenders have been in the organization of developing consumer relationship, and now we promote reasonable homes. To me that’s a workable relationship.”