Learn how you happen to be able to get mortgage assist as a consequence of Georgia’s COVID resident-save program.

In early 2021, President Joe Biden closed new Western Save yourself Plan Act to your law. Which legislation authored a citizen Recommendations Finance, a national system, to provide $10 mil on the says to help domiciles that are about on their mortgages or any other houses expenditures on account of COVID-19.

Eligible property owners for the Georgia who’ve educated a pecuniary hardship due to COVID-19 could possibly get a few of the approximately $354 billion allocated to the official-around $fifty,000 for every domestic-through the use of towards the Georgia Financial Assistance system. This option spends federal money to greatly help residents make home loan repayments and spend other family-associated will set you back.

Available Financial help to have Georgia People

- You could be in a position to be eligible for money to help you reinstate the delinquent home mortgage. You can also be eligible discover possibly around three weeks off additional mortgage repayments if you have not yet , retrieved economically.

- You are eligible a-one-big date payment for the financial to reduce the mortgage balance (a primary curtailment).

- You could possibly get money to pay overdue low-escrowedproperty taxation, homeowners’ insurance coverage, condo or homeowners’ organization costs, and you can utility payments.

Even in the event a foreclosure has started, you may still have enough time to locate help from the brand new Georgia Home loan Direction program. Notify the loan servicer which you have used on the applying. But not, you have to know you to making an application for guidance will most likely not prevent a great foreclosures. After you pertain, notify the application form manager concerning the property foreclosure and supply a duplicate of the document appearing that a foreclosures business could have been scheduled for your house so that your application will likely be quick-monitored.

You could also have enough time to sort out an alternative to property foreclosure with your loan servicer. Of course you may have questions relating to the latest foreclosures processes during the Georgia otherwise must realize about prospective defenses so you’re able to a property foreclosure, imagine talking to a foreclosure lawyer.

Qualification Conditions for the Georgia Mortgage Advice Program

To be eligible for respite from this program, you really need to have sustained a monetaray hardship (a material reduction in money otherwise an increase in living expenses) immediately after , on account of COVID-19. If your pecuniary hardship is actually recovered which have a separate give or kind of recommendations, you are not eligible.

- Your house must be located in Georgia.

- You must be currently located in the home since your top residence, therefore should have become staying in the house at the time of the adversity. (Second land, financial support services, and you can empty attributes usually do not meet the requirements. Are formulated home loans, although not, qualify.)

- The house must be titled from the label away from good pure individual, maybe not a keen LLC, faith, or company.

- For those who have a home loan, it will was in fact a compliant loan in the origination.

- Your family members money must be equal to or lower than 100% of one’s town median earnings (AMI) for the condition. Or your family members money must be equal to or below 150% of the county’s AMI for folks who (new homeowner), debtor, otherwise partner is considered a great socially disadvantaged private, like those which have been the fresh victim out of racial or ethnic bias or cultural bias, or people who have minimal English competence, particularly.

Homeowner recommendations applications and requires changes commonly, and not most of the loan providers and you will servicers take part. Definitely see the authoritative Georgia Mortgage Direction site to possess the newest information and you can qualification criteria.

Ideas on how to Sign up for Assistance from the latest Georgia Mortgage Recommendations System

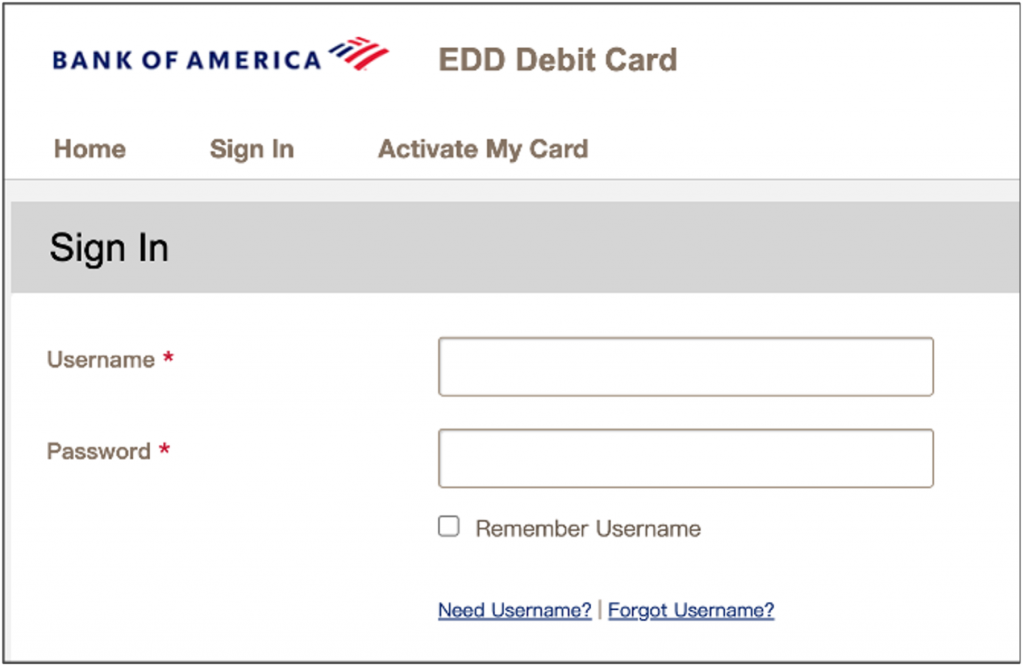

Visit the Georgia Financial Recommendations website to apply for help using this program. You are going to need to render specific files with your software, particularly mortgage statements otherwise statements for the most other homes-associated will set you back, evidence of earnings (such as for instance pay stubs and tax returns), and you can a government-granted ID (instance a driver’s license).

What’s the Due date to apply to the Georgia Mortgage Guidelines Program?

The applying will stay through to the prior to of , or when most of the money assigned to the program has been fatigued. If you believe you could potentially be considered, you need to pertain as fast as possible.

End Homeowner Recommendations Loans Frauds

Should you get an unwanted provide from the mobile phone, in the U.S. mail, by way of email, otherwise by the text giving home loan recovery or foreclosure cut services, be wary. Fraudsters often target home owners having trouble with the construction money.

The newest Georgia Home loan Recommendations system is free. In the event that individuals requires you to definitely spend a charge discover casing counseling or to discovered foreclosures cures qualities from loans Coosada AL this program, its a fraud. Definitely declaration any cases of con.

Learn more about the brand new Georgia Financial Guidelines System

When you yourself have issues or need help along with your software, call 770-806-2100, 877-519-4443, email , otherwise comment the Georgia Home loan Guidelines system Faqs.

Including, envision calling a great HUD-approved construction specialist who will assist you free-of-charge. To acquire a therapist in your area, head to HUD’s website or label 800-569-4287.